“The respondents of the Wave 24 Executive Survey Insights appear to be cautiously optimistic, with hope that the shadow of the pandemic weathered over the past year is fading. The share of organizations reporting deceleration in the pace of move-ins and declines in occupancy rates is at the time series low for all care segments. In looking back over the past year and the 24 iterations of the Executive Survey Insights results, it’s apparent how closely the survey’s results have mirrored the reality experienced by many operators as they faced daily struggles to keep their residents and staffs safe from contagion—and to save lives.”

–Lana Peck, Senior Principal, NIC

Launched one-year ago in mid-March 2020 as part of a broader effort by NIC to provide timely understanding of the impact of the COVID-19 pandemic across the seniors housing and nursing care sectors—the single biggest challenge ever faced by operators—this continuously running, bi-weekly, Executive Survey Insights analysis has been widely viewed and closely monitored by many industry stakeholders, operators, developers, investors, lenders, and analysts.

Yielding data on properties of every size, type, ownership structure, and across each care segment, every completed questionnaire delivers information from the perspective of an owner/operator’s entire portfolio of seniors housing and nursing care properties. Typically garnering around 80 responses on average, the survey has provided real-time insights on hundreds of buildings and thousands of units across the country every two weeks since near the beginning of the pandemic.

Detailed reports for each “wave” of the survey and a PDF of the report charts can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights. Additionally, the full range of time series data for each wave of the survey by care segment for move-ins, move-outs and occupancy rate changes can be found here.

The survey has provided a flexible medium for owners and operators of seniors housing and nursing care properties to deliver transparency to the industry as market conditions have rapidly changed. Early in the time series, in March and April 2020, the survey tracked operators’ mitigation strategies for labor shortages that were aggravated during the pandemic, availability of PPE, and the many ways operators were supporting property staff and their families during the crisis. Later in the series, the survey tracked the needs of operators in keeping residents and staff safe. Answers to questions pertaining to improvement in access to PPE and COVID-19 testing kits, time frames for receiving test results, and, more recently in the 2021 surveys, the availability, administration, and distribution of COVID-19 vaccines—demonstrates how the full continuum of this survey has kept the industry and the media informed about daily challenges and successes on the front lines and in the properties themselves.

With a year’s worth of time-series data documenting the impact of the pandemic on senior living, the survey has and will continue to track a number of standard topics focused on the market fundamentals including the pace of move-ins and move-outs, changes in occupancy rates by care segments, utilization of rent concessions to support occupancy, and factors pressuring NOI.

The result is a cross-section of America’s seniors housing and nursing care industries, a consistent indicator of trends, updated almost in real-time. Each of the 24 “waves” of the survey data has provided directional insights while preceding sources of other data by weeks and months, working to help ensure the wider narrative on the sector is accurate.

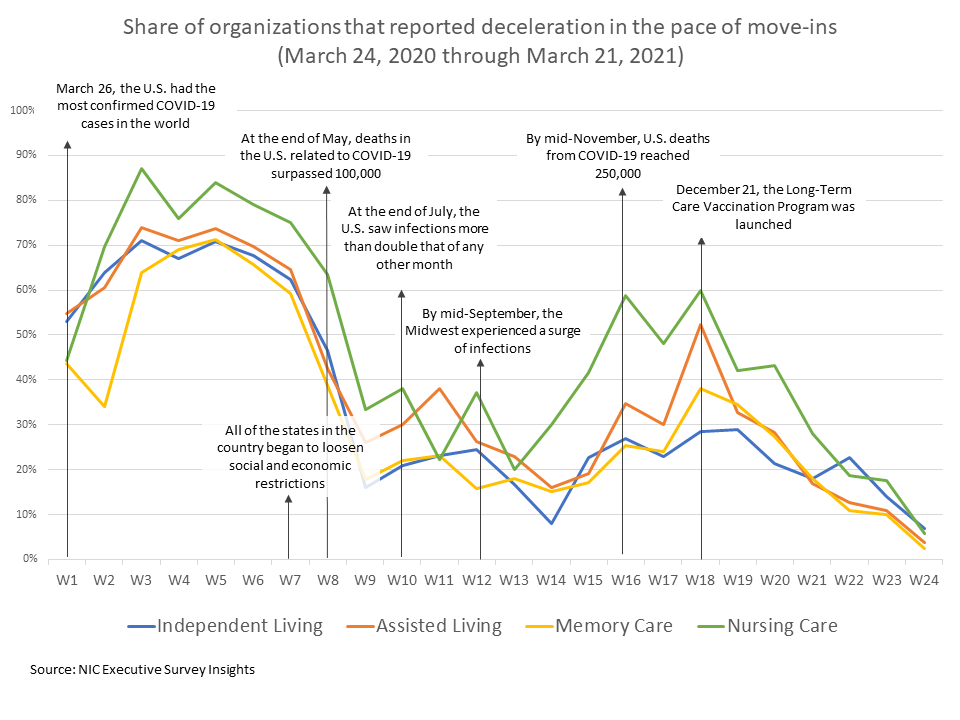

Timeline of Executive Survey Insights and the Coronavirus Pandemic in the U.S.

Across the time series from March 2020 to March 2021, the Executive Survey Insights results have shown clear trends that have corresponded with the broad incidence of COVID-19 infection cases in the United States. The chart below illustrates the drastic slowdown in seniors housing and care move-ins by care segment early in the pandemic, followed by somewhat of a stabilization over the summer, and another tapering off as conditions worsened in the fall. By Wave 18, the COVID-19 vaccine had begun to be distributed across the country through the Long-Term Care Vaccination Program (in the latter half of December) and the pace of move-ins accelerated as reflected in operators’ subsequent experiences in Waves 19 through 24. Currently, in Wave 24, the shares of organizations reporting deceleration in the pace of move-ins has fallen to time series lows across each of the care segments.

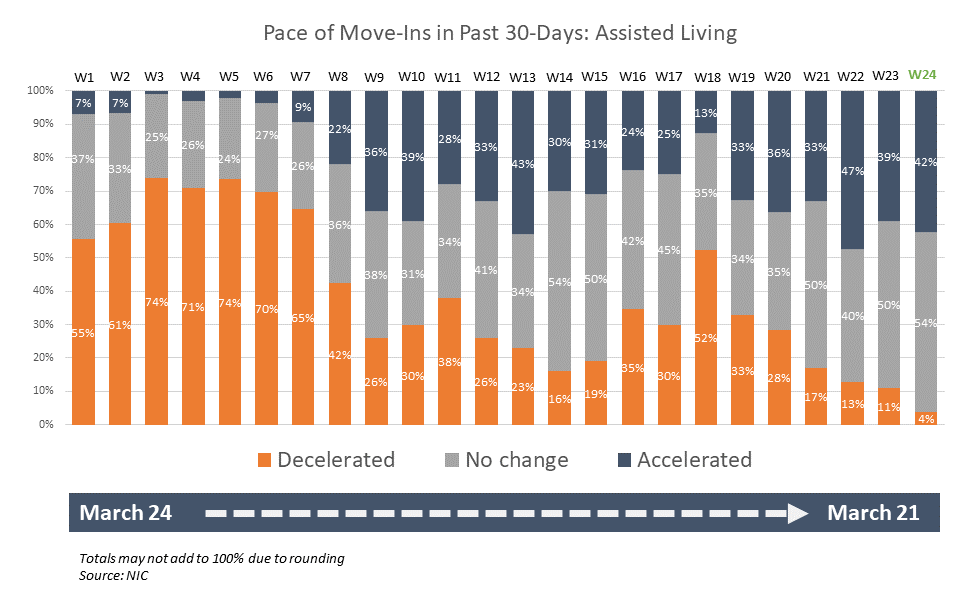

The following narrative is an examination of the past 12 months of survey data from near the beginning of the pandemic through to current conditions. For context, the chart below, which details 24 waves of survey data regarding the pace of move-ins (for assisted living as an example), shows how closely the survey’s results have mirrored the reality experienced by many seniors housing and care operators during the various waves of the pandemic, and lays out a framework for the time intervals to be discussed. How far has the industry come and how much further does it need to go in order to resume pre-pandemic operations in what will be considered the “new normal” going forward?

Survey Waves 1-10 (March 24 – August 2, 2020)

Early in the pandemic, the most common reason cited by operators for deceleration in move-ins was a slowdown in leads conversions/sales due to moratoriums of moving residents into communities to mitigate COVID-19 contagion within seniors housing and care buildings. Ultimately, these bans on move-ins resulted in challenges backfilling vacancies. Respondents also noted at the time that they were seeing fewer hospital referrals or elective surgeries that had reliably served to bring in residents for therapy and rehabilitation stays prior to the pandemic.

By Wave 9, in addition to bans on move-ins abating, survey respondents commented that resumption of pre-COVID-19 planned resident move-ins, improving availability of COVID-19 testing prior to entry, and lessons learned regarding sanitation measures and enhanced safety protocols for visiting with social distancing were implemented to provide reassurance about moving into seniors housing.

Survey Waves 11-15 (August 17 – November 8, 2020)

Presumably due to new spikes of COVID-19 cases in many areas of the country or possibly due to restrictions on family member visitation rules imposed by some states, more organizations in Wave 11 than in all of the prior waves of the survey cited resident or family member concerns with moving a loved one into senior living.

While accurate and timely COVID-19 testing (within 48-hours) was considered crucial to operators’ ability to settle new residents into communities and keep them safe from outside contagion—which could be brought into community by visitors and staff—nearly two-thirds of organizations were waiting three to five days for test results to come back, and still only about one-half of respondents found it easy to obtain PPE and COVID-19 test kits. Frustration with testing turnaround times was expressed in the survey comments with some respondents fearing that the impact of the testing delays could result in difficulty mitigating infection control, further slowing the pace of move-ins, and hampering their ability to replace census.

By Waves 12 and 13, battling the pandemic was putting a strain on operating costs. Although the pace of move-ins had picked up somewhat in the summer months, more organizations were using agency or temp staff to fill staffing vacancies, adding to increasing operating costs since the pandemic began. Further, the share of survey respondents offering rent concessions to attract new residents in Wave 12 had grown to approximately one-half—a level that remained consistent going forward.

The use of rent concessions appeared to provide some support to occupancy rates as month-over-month seniors housing care segment occupancy changes (from 30-days prior) in Waves 14 and 15 trended higher than in recent waves of the survey. The loss of revenue associated with a decline in occupancy rates across care segments in conjunction with rising expenses associated with staffing, PPE, and testing protocols was putting acute pressure on NOI for many operators and their capital partners. Beginning early in the pandemic, the majority of organizations had been bolstering staffing deficiencies with additional overtime hours.

Survey Waves 16-20 (November 9, 2020 – January 24, 2021)

The fall surge of the coronavirus resulted in another slowdown in the pace of move-ins, and an increase in the share of organizations reporting residents waiting to move in. Presumably as a result of better and safer visitation protocols and more acceptance, resident or family member concerns cited as a reason for acceleration in the pace of move-outs was then at the lowest level in the survey time series.

By Wave 19, NOI continued to be pressured as nine out of ten organizations were still paying staff overtime hours and two out of three were using agency or temp staff to backfill staffing shortages. The higher levels of care segments (assisted living, memory care, and nursing care) reported increases in PPE budgets commensurate with growing levels of care. Additionally, organizations with the largest portfolios of properties were more likely to report significantly higher PPE budget increases than single-site operators.

The drag on occupancy rates continued to be observed in the Wave 19 survey results, likely reflecting a combination of challenges in backfilling COVID-related vacancies as well as the effects of typical seasonality during the holidays and winter months. Despite reports of record-high COVID-19 cases across the country occurring daily, roughly two-thirds of respondent organizations were not increasing move-in restrictions presumably in part due to operator innovations in infection mitigation and creative visitation protocols which have gained acceptance from many residents and families.

Long-anticipated as a game-changer with regard to improving occupancy, many operators were starting to receive the COVID-19 vaccine. In December, the CDC prioritized skilled nursing and assisted living residents and staff members in phase 1a of the COVID-19 vaccine distribution. In Wave 20, ending January 24, 2021, four out of five organizations had finished their first clinic.

Survey Waves 21-23 (January 25 – March 7, 2021)

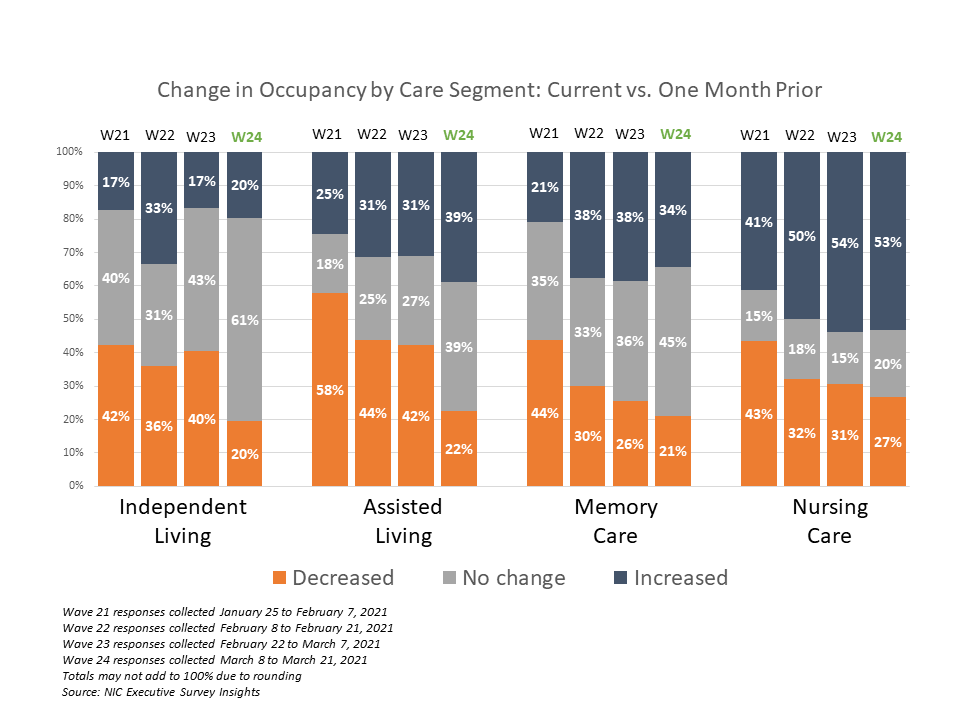

Amid growing optimism among operators, in late January when the survey data had yet to show an upward trend in occupancy, respondents were starting to notice an increase in prospect interest specifically related to the availability of the vaccine. Positive signals became palpable in the Wave 22 survey results, which revealed upward shifts in organizations reporting acceleration in move-ins and occupancy increases across each of the care segments. Data compiled in NIC’s Skilled Nursing COVID-19 Tracker clearly showed that COVID-19 cases in skilled nursing communities were falling at a faster pace compared to the U.S. since the launch dates of the Pfizer and Moderna vaccines in long-term care settings, and more organizations with memory care units and/or nursing care beds reported increases in occupancy than decreases since prior to the fall surge of the coronavirus.

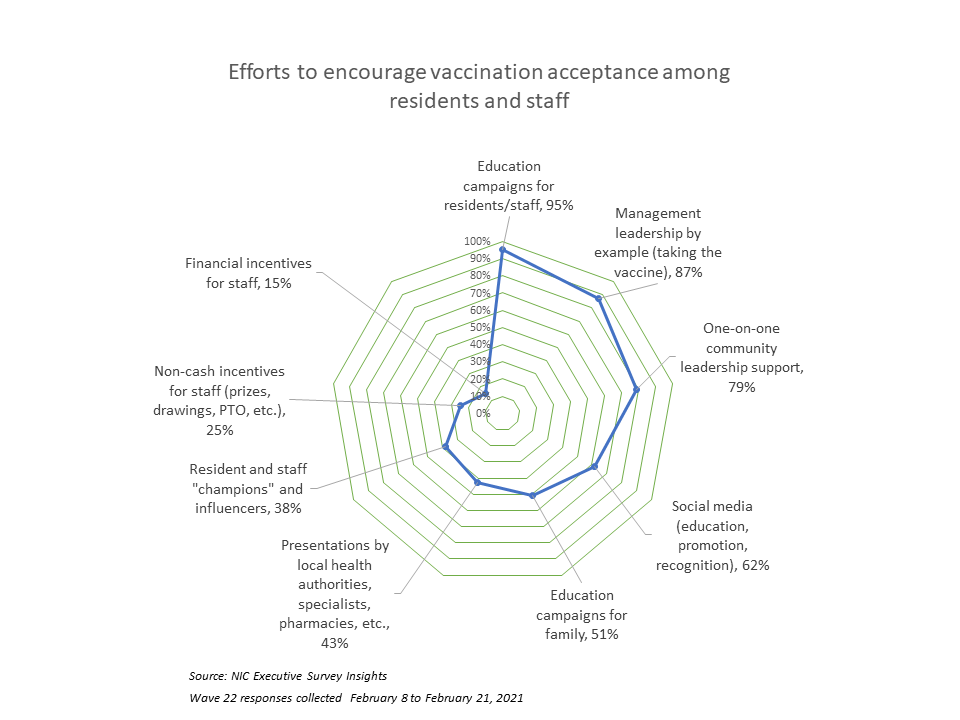

Roughly nine out of ten respondents in the Wave 22 survey indicated that educating and motivating staff to take the vaccine was a challenge, and operators applied a variety of strategies to encourage and improve vaccine acceptance. In addition to education/communication campaigns, community and corporate leadership stepped up and publicly took the vaccine themselves and the majority have been personally available with one-on-one support for concerned staff. Few respondent organizations have incentivized staff to take the vaccine with financial benefits.

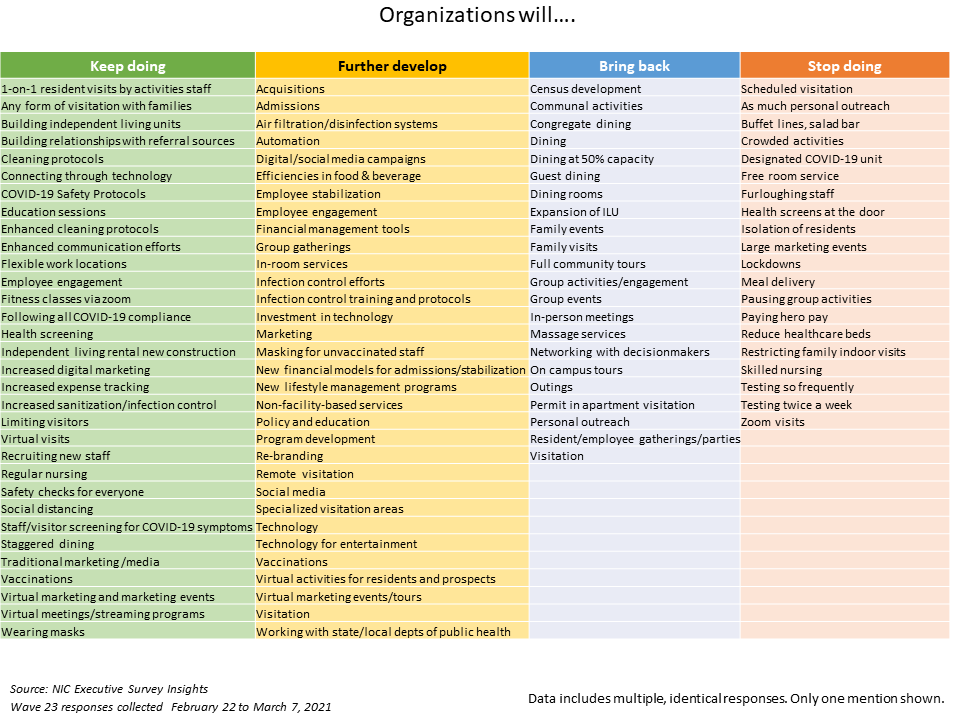

Nearly one year into the coronavirus crisis, the pandemic has necessitated many changes in the way seniors housing and care operators do business. In the NIC Executive Survey Insights Wave 23 results, respondents were asked to list one of the things that their organization plans to keep doing, stop doing, bring back and further develop. In addition to maintaining COVID-19 and infection mitigation protocols, organizations will continue leveraging virtual technologies for a variety of uses including digital marketing campaigns, entertainment, remote visits, and some activities. With most of survey respondents’ residents being fully vaccinated, seniors housing and care operators have begun to look forward to bringing back communal dining, group activities, resident/employee gatherings, and discontinuing visitation restrictions, meal delivery, pandemic staff benefits, and frequent COVID-19 testing.

Survey Wave 24 (March 8 – March 21, 2021)

Currently, with about nine out of ten organizations reporting their residents are fully vaccinated, operator optimism about occupancy recovery continues to grow. More than one-third (38%) think their organizations’ occupancy rates will return to pre-pandemic levels this year. To boost occupancy, approximately 60% of organizations are now offering rent concessions, approaching the peak reached in Wave 17.

In Wave 24, increased resident demand was cited by 85% of respondents as a reason for acceleration in move-ins in the past 30-days, and the shares of organizations reporting deceleration in the pace of move-ins and occupancy decreases is at time series low for all care segments.

Organizations that have seen a notable increase in prospect interest specifically due to the availability of the COVID-19 vaccine has grown from 25% in Wave 21 to 46% in Wave 24. However, staffing shortages experienced by operators prior to and exacerbated by the pandemic persist in Wave 24: three-quarters (77%) of organizations report staffing shortages in their portfolios of properties.

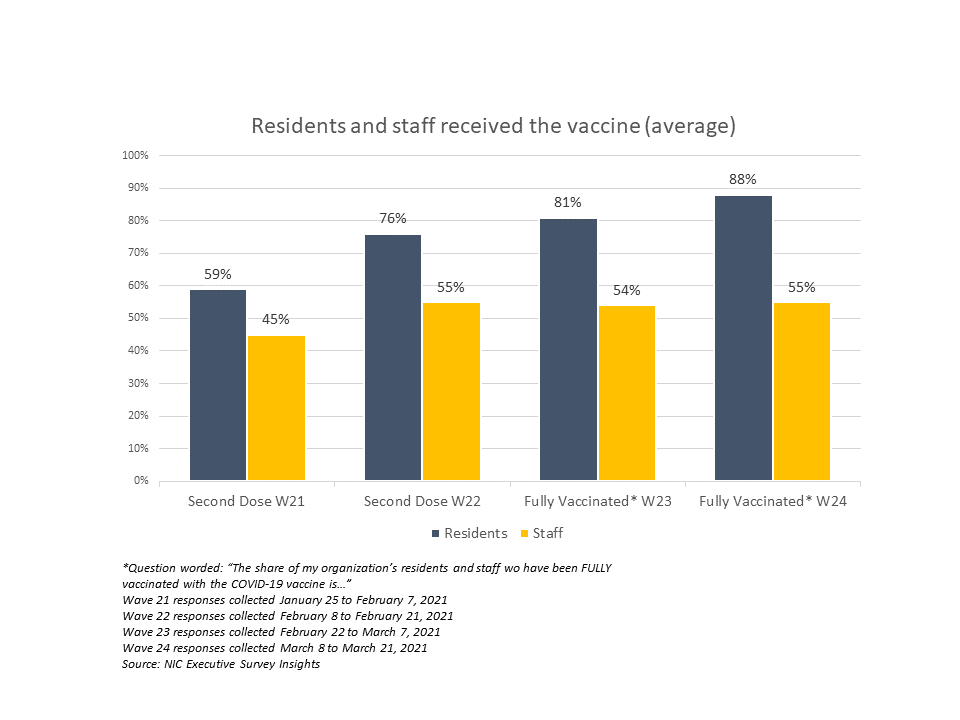

According to the Wave 24 survey respondents, the average percentage of staff who have been fully vaccinated remains at a stagnant 55%. Between Waves 21 and 24, staff uptake of the vaccine to fully vaccinated levels remained flat. Given these results, one in five respondents (20%) say they definitely or probably will make the COVID-19 vaccine mandatory for staff members—similar to the Wave 23 survey (25%) and higher than in Wave 22 when 11% said they planned to make the vaccine mandatory for staff at that time.

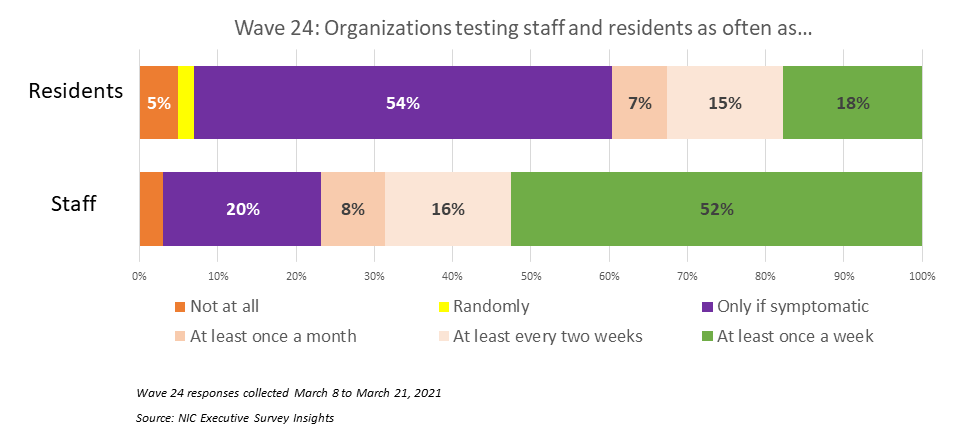

Interestingly, although respondents in Wave 23 indicated they were looking forward to less COVID-19 testing, the lack of staff vaccination growth continues to put strain on operating costs for COVID-19 testing. Where one-half of organizations (52%) are testing staff at least once a week, one-half (54%) are testing residents only if symptomatic.

Going forward as vaccine optimism replaces uncertainty, the NIC Executive Insights Survey will track changes in the seniors housing and care sector with continued focus on the market fundamentals, labor and staffing, and factors that affect NOI. From time to time, new questions will be asked as conditions necessitate. NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to advance clarity and transparency during the course of the pandemic.

Wave 24 Survey Demographics

- Responses were collected between March 8 and March 21, 2021 from owners and executives of 64 seniors housing and skilled nursing operators from across the nation. Owner/operators with 1 to 10 properties comprise more than one-half of the sample (61%). Operators with 11 to 25 properties make up under one-quarter of the sample (20%), while operators with 26 properties or more make up 19% of the sample.

- One-half of respondents are exclusively for-profit providers (51%), one-third (34%) are nonprofit providers, and 15% operate both for-profit and nonprofit seniors housing and care organizations.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 75% of the organizations operate seniors housing properties (IL, AL, MC), 33% operate nursing care properties, and 33% operate CCRCs (aka Life Plan Communities).

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By demonstrating transparency, you can help build trust. The survey results and analysis are frequently referenced in media reports on the sector including in McKnight’s publications, Mortgage Professional America Magazine, Senior Housing News, Multi-Housing News, Provider Magazine, and other industry-watching media outlets. The surveys’ findings have also been mentioned in stories by Kaiser Health News, CNN, the Wall Street Journal, and other major news outlets across the U.S.

The Wave 25 survey is available and takes 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.