NIC’s Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into market fundamentals in the seniors housing and care space at a time when market conditions continue to change—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector.

This Wave 13 survey sample includes responses collected from September 28-October 11, 2020 from owners and executives of 73 seniors housing and skilled nursing operators from across the nation. Detailed reports for each “wave” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Wave 13 Summary of Insights and Findings

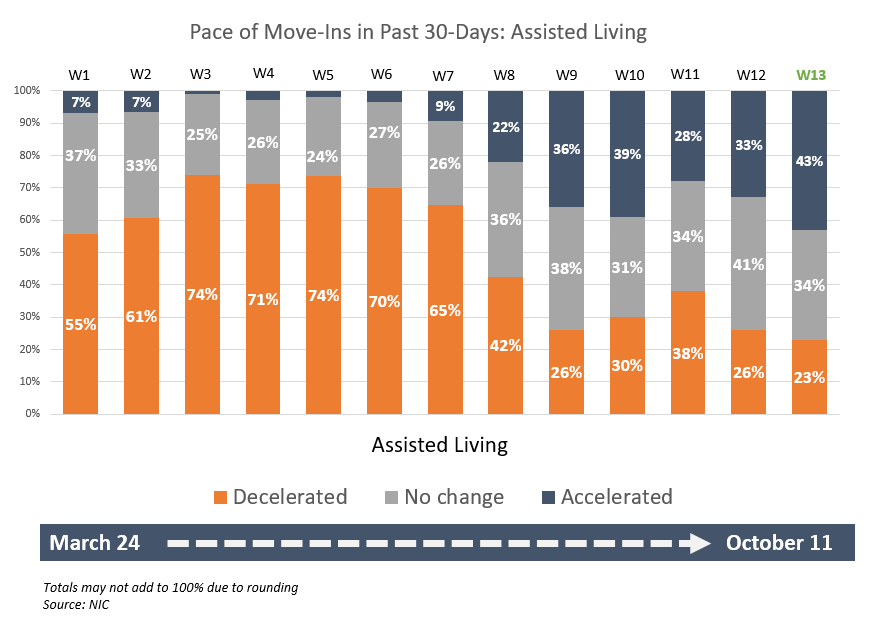

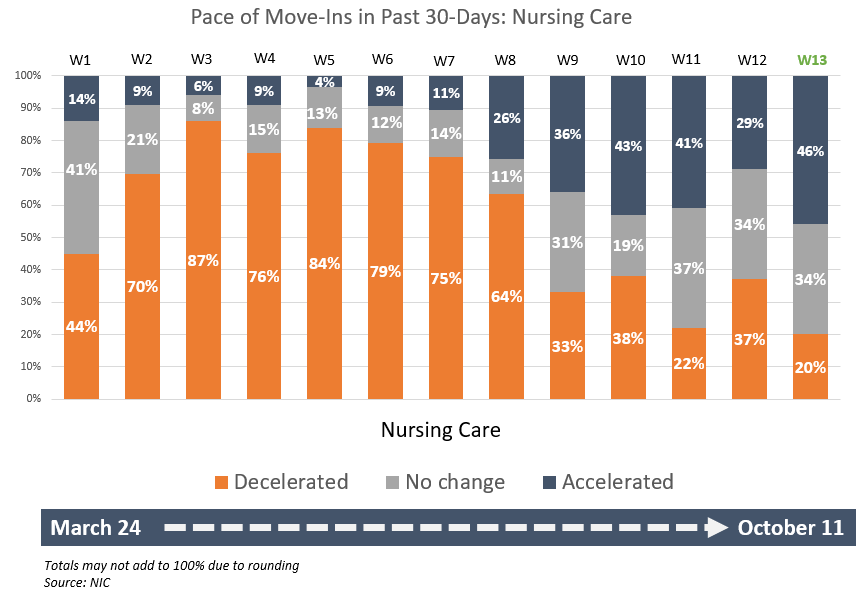

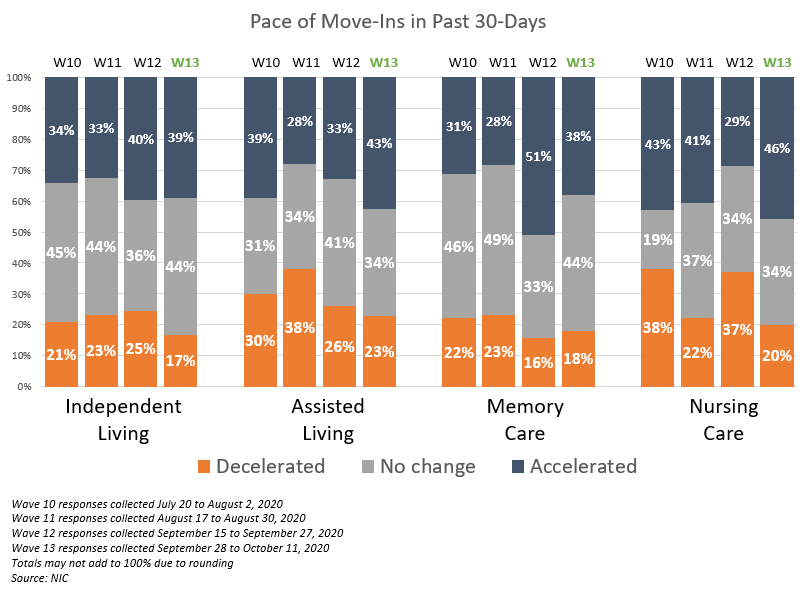

The shares of organizations with assisted living units and/or nursing care beds reporting an acceleration in the pace of move-ins in the past 30-days rose to the highest levels since the survey began in March (43% and 46%, respectively). Coupled with fewer organizations reporting an acceleration in the pace of move-outs, more organizations reported upward changes in occupancy for these care segments. Acceleration in move-ins was most frequently attributed to increased resident demand, with one-quarter of respondents indicating that their organizations had a backlog of residents to move into their communities. Organizations citing resident or family member concerns as a reason for deceleration in move-ins (presumably due to the uncertainty of the prevalence of COVID-19 in the fall months and potential for restrictions on visitation) declined from three-quarters to two-thirds but remains higher than in prior surveys. While accurate and timely testing (within 48-hours) is crucial to operators’ ability to settle new residents into communities and keep them safe from outside contagion which could be brought in by visitors or staff, nearly two-thirds of respondents were waiting three days or more for test results, and still only about one-half of respondents find it easy to obtain PPE and COVID-19 test kits.

-

- In Wave 13, approximately 40% of organizations with independent living, assisted living, and/or memory care segments and nearly one-half of organizations with nursing care beds (46%) reported that the pace of move-ins had accelerated in the past 30 days.

- The share of organizations citing increased resident demand as a reason for the acceleration in move-ins in Wave 13 remained high (85%). Some respondents noted greater urgency among new residents regarding move-ins in geographies where restrictions have been lifted; others cited new buildings leasing up, and resident transfers to higher levels of care.

- Regarding reasons for a deceleration in move-ins, more organizations in Wave 13 than in Wave 12 cited a slowdown in leads conversions/sales (82% vs. 55%). Resident or family member concerns also remained high in Wave 13 (68%) but declined slightly since Waves 12 and 11 (73% and 74%, respectively).

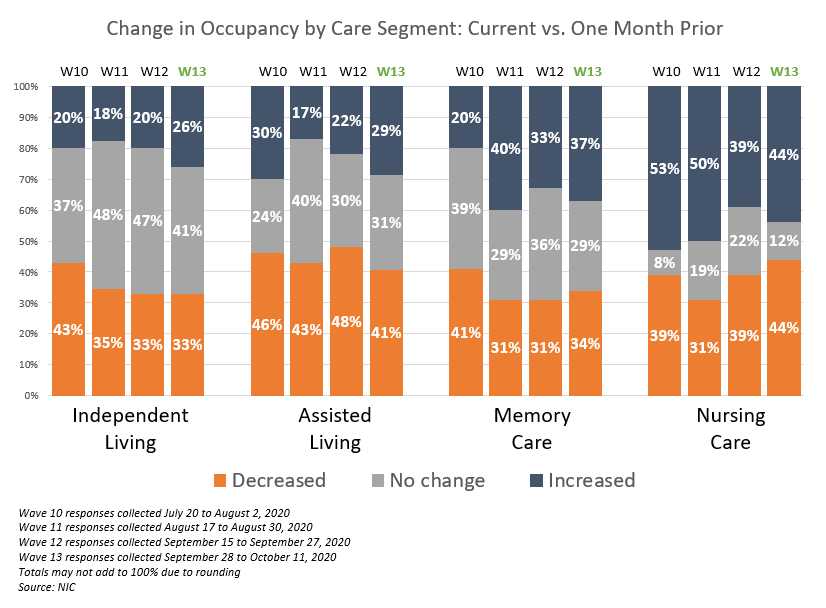

- In Wave 13, organizations with nursing care beds reported both the highest proportion of month-over-month occupancy increases (44%) and decreases (44%). Greater shares of organizations across all care segments in Wave 13 reported upward changes in occupancy than in Wave 12 (to varying degrees). However, more organizations with assisted living and independent living report occupancy decreases than occupancy increases.

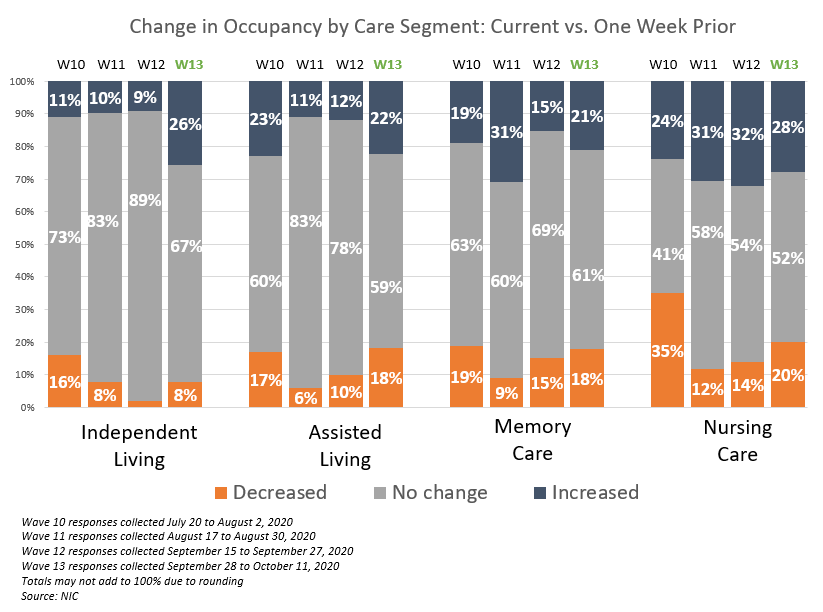

- Looking forward, between 21% and 26% of organizations with independent living, assisted living, and/or memory care units, and 28% of organizations with nursing care beds reported an increase in week-over-week occupancy. Organizations with nursing care beds and/or independent living units reported the highest shares of week-over-week occupancy increases. However, the majority of respondents cited no changes in occupancy from the prior week.

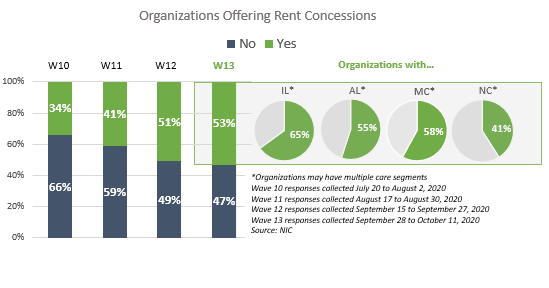

- The strain on operating costs persist as three-quarters of organizations continued to provide staff overtime hours, and one-half continued to offer rent concessions to attract new residents—up from one-third in Wave 10. Of the organizations that operate any independent living units (including a combination of other seniors housing and care segments), two-thirds (65%) were currently offering rent concessions, followed by roughly one-half of organizations with any memory care and/or assisted living units (58% and 55%, respectively). About two in five organizations with any nursing care beds (41%) reported offering rent concessions.

Wave 13 Survey Demographics

-

- Responses were collected from September 28-October 11, 2020 from owners and executives of 73 seniors housing and skilled nursing operators from across the nation. More than half of respondents are exclusively for-profit providers (61%), about one-third (31%) are exclusively nonprofit providers, and 8% operate both for-profit and nonprofit seniors housing and care organizations.

- Owner/operators with 1 to 10 properties comprise 63% of the sample. Operators with 11 to 25 properties make up 18% of the sample, while operators with 26 properties or more make up 19% of the sample.

- Many respondents in the sample report operating combinations of property types. Across their entire portfolios of properties, 79% of the organizations operate seniors housing properties (IL, AL, MC), 21% operate nursing care properties, and 34% operate CCRCs (aka Life Plan Communities).

Key Survey Results

Pace of Move-Ins and Move-Outs

Respondents were asked: “Considering my organization’s entire portfolio of properties, overall, the pace of move-ins and move-outs by care segment in the past 30-days has…”

-

- The shares of organizations with assisted living units and/or nursing care beds that reported an acceleration in move-ins in the past 30-days increased in Wave 13 to the highest levels since the survey began in March (43% and 46%, respectively). For both of these care segments, the shares of organizations reporting deceleration in the pace of move-ins were the lowest in the time series (23% and 20%, respectively).

-

- In Wave 13, approximately 40% of organizations with independent living, assisted living, and/or memory care segments compared to nearly half (46%) of organizations with nursing care beds reported that the pace of move-ins had accelerated in the past 30-days.

- The shares of organizations experiencing an acceleration of move-ins in independent living in Waves 12 and 13 were higher than in previous waves of the survey, and near the time series peak reached in Wave 9 surveyed at the end of June.

Reasons for Acceleration/Deceleration in Move-Ins

Respondents were asked: “The acceleration/deceleration in move-ins is due to…”

-

- The share of organizations citing increased resident demand as a reason for the acceleration in move-ins in Wave 13 remained high (85%) after peaking in Wave 12 (88%). Organizations citing hospital placement in Wave 13 (30%) is lower since the peak reached in Wave 10 surveyed in the latter half of July (41%).

- Regarding reasons for a deceleration in move-ins, more organizations in Wave 13 than in Wave 12 cited a slowdown in leads conversions/sales (82% vs. 55%). Resident or family member concerns also remained high (68%) but declined slightly since Waves 12 and 11 (73% and 74%, respectively). Very few organizations cited a moratorium on move-ins as a reason for deceleration in the pace of move-ins (5%). This is down from 61% at its peak in Wave 4 surveyed in the latter half of April.

Organizations Currently Offering Rent Concessions to Attract New Residents and Organizations Experiencing a Backlog of Residents Waiting to Move-In

Respondents were asked: “My organization is currently offering rent concessions to attract new residents,” and “My organization is experiencing a backlog of residents waiting to move-in”

-

- Half of the organizations in both Waves 12 and 13 were offering rent concessions to attract new residents (51% and 53%, respectively)—up from one-third in Wave 10 (34%).

- Of the organizations that operate any independent living units (including a combination of other seniors housing and care segments), two-thirds (65%) indicated they were currently offering rent concessions, followed by roughly one-half of organizations with any memory care and/or assisted living units (58% and 55%, respectively). About two in five organizations with any nursing care beds (41%) reported offering rent concessions.

- Digging deeper, organizations with CCRCs in their portfolios were less likely to be currently offering rent concessions than organizations without CCRCs (48% vs. 56%). Additionally, the majority of organizations with declining occupancy in assisted living and/or memory care were currently offering discounts.

- Approximately one-quarter of respondents in Waves 12 and 13 indicate that their organizations have a backlog of residents waiting to move in (25% and 26%, respectively).

Move-Outs

-

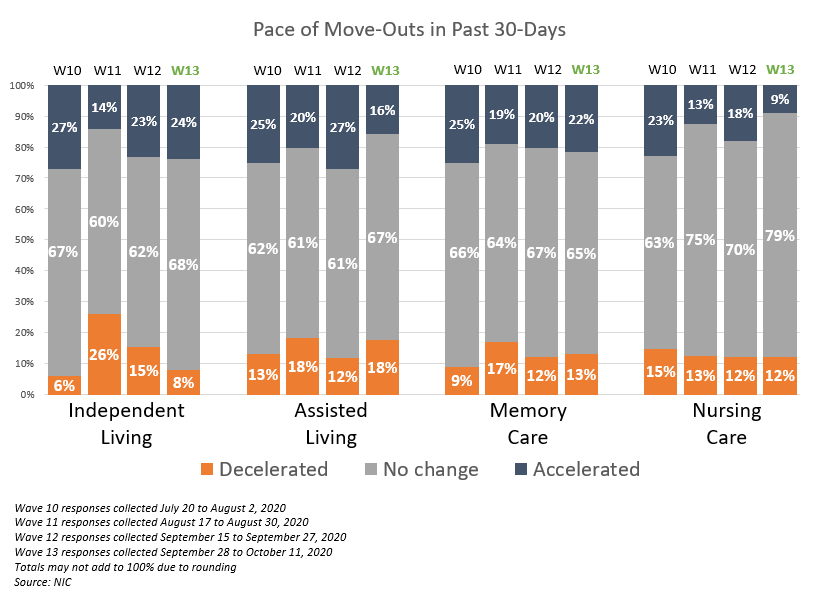

- The shares of organizations reporting an acceleration in the pace of move-outs decreased in Wave 13 for the assisted living and nursing care segments. The majority of organizations in Wave 13 continue to note no change in the pace of move-outs in the past 30 days. This has been consistent since the survey began in late March.

Change in Occupancy by Care Segment

Respondents were asked: “Considering the entire portfolio of properties, overall, my organization’s occupancy rates by care segment are… (Most Recent Occupancy, Occupancy One Month Ago, Occupancy One Week Ago, Percent 0-100)”

-

- In Wave 13, organizations with nursing care beds reported both the highest proportion of month-over-month occupancy increases and decreases (44%). The share of organizations reporting nursing care occupancy decreases is the highest since Wave 8 surveyed in late May to early June.

-

- Greater shares of organizations across all care segments in Wave 13 than in Wave 12 reported increasing occupancy. However, more organizations with assisted living and independent living report occupancy decreases than occupancy increases.

-

- Regarding the change in occupancy from one week ago, between 21% and 26% of organizations with independent living, assisted living, and/or memory care units and 28% of organizations with memory care beds reported an increase in week-over-week occupancy. The majority of respondents cited no changes in occupancy from the prior week. Organizations with nursing care beds and/or independent living units reported the highest shares of week-over-week occupancy increases.

Improvement in Access to PPE and COVID-19 Testing Kits

Respondents were asked: “Considering access to PPE (personal protective equipment) and COVID-19 testing kits, my organization has experienced that access has improved… Very little, it is still difficult to obtain enough PPE/testing kits in most markets/Somewhat, in some markets it is easier to obtain PPE/testing kits than in others/Considerably, we typically have no difficulty obtaining PPE/testing kits, regardless of market”

-

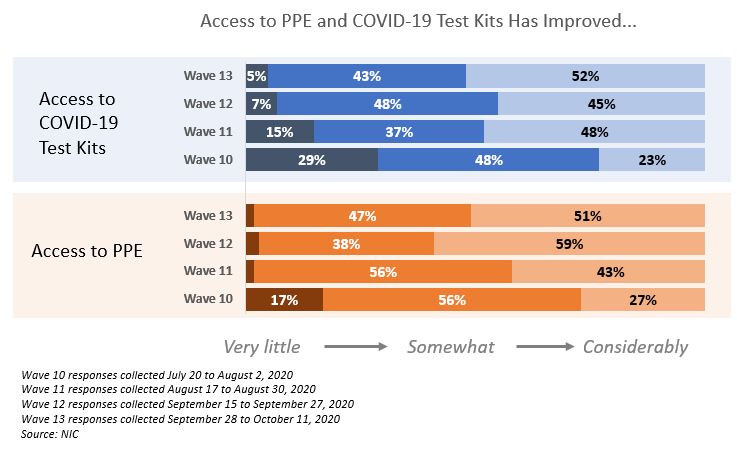

- While there’s been some improvement in recent waves of the survey, still only about half of the respondents find it easy to obtain PPE and COVID-19 test kits. Slightly fewer respondents reported no difficulty getting PPE in Wave 13 than in Wave 12 (51% vs. 59%), however, slightly more in Wave 13 noted no difficulty getting COVID-19 test kits (52% vs. 45%).

Time Frames for Receiving Back COVID-19 Test Results

Respondents were asked: “Regarding COVID-19 test results (either for staff, residents or prospective residents) results typically come back within…”

-

- The time frames for receiving back COVID-19 test results did not continue to trend as positively in Wave 13 as Wave 12. Just over one-third of respondents (38%) received their COVID-19 test results within 2 days, down from 43%.

- Importantly, the majority (62%) note that it still takes more than 3 days to receive test results—however, this is down from 87% in Wave 10.

Labor and Staffing

Respondents were asked: “My organization is backfilling property staffing shortages by utilizing … (Choose all that apply).” Note: this question was asked in Wave 3, and then again in Waves 10-13.

-

- Three-quarters of organizations (76%) are continuing to offer staff overtime hours in Waves 12 and 13 (down from 85% in Wave 3), and roughly half are still using agency or temp staff to fill staffing vacancies—up from 36% in Wave 3.

Owners and C-suite executives of seniors housing and care properties, we’re asking for your input! By providing real-time insights to the longest-running pulse of the industry survey you can help ensure the narrative on the seniors housing and care sector is accurate. By demonstrating transparency, you can help build trust.

“…a closely watched Covid-19-related weekly survey of [ ] operators

conducted by the National Investment Center for Seniors Housing & Care…”

The Wall Street Journal | June 30, 2020

The Wave 14 survey is available until Sunday, October 25, and takes just 5 minutes to complete. If you are an owner or C-suite executive of seniors housing and care and have not received an email invitation to take the survey, please click this link or send a message to insight@nic.org to be added to the email distribution list.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors housing and care space at a time where trends are continuing to change.

About Lana Peck

Lana Peck, former senior principal at the National Investment Center for Seniors Housing & Care (NIC), is a seniors housing market intelligence research professional with expertise in voice of customer analytics, product pricing and development, market segmentation, and market feasibility studies including demand analyses of greenfield developments, expansions, repositionings, and acquisition projects across the nation. Prior to joining NIC, Lana worked as director of research responsible for designing and executing seniors housing research for both for-profit and nonprofit communities, systems and national senior living trade organizations. Lana’s prior experience also includes more than a decade as senior market research analyst with one of the largest senior living owner-operators in the country. She holds a Master of Science, Business Management, a Master of Family and Consumer Sciences, Gerontology, and a professional certificate in Real Estate Finance and Development from Massachusetts Institute of Technology (MIT).

Connect with Lana Peck

Read More by Lana Peck